Investor Trust has created a long-term investment designed to help you prepare financially for your retirement. It is a straightforward and easy to understand product which tracks the S&P 500 and offers investors “unlimited growth and downside protection”. The vehicle provides a guaranteed return in combination with an opportunity to take advantage of the market growth of the S&P 500 Index. This combination of benefits means that it is currently one of the best products available on the market.

What is the S&P 500 Index?

The S&P 500 is essentially an index of the largest public limited companies in the US. These are the country’s most successful companies, many of whom will have been “listed” for decades. When you invest in the “index”, you are investing in the combined performance of all of those 500 companies, thus spreading the risk, making it the ideal strategy for retirement planning.

The financial markets are packed with different instruments, vehicles and strategies designed to maximise your wealth. We have all heard of hedging and hedge funds, long and shorts, put/call options and derivatives, not to mention the range of cryptocurrencies which are continually increasing in number.

All of these are sophisticated investment tools that vary in their levels of risk. However, if you listen to renowned investor Warren Buffet, your best option is to invest your money for the long-term in the form of a “tracker fund” which follows the S&P 500. Speaking to CNBC’s Squawk Box, Buffett claimed if that if you had invested $10,000 in an index fund in 1942, it would be worth approximately $51 million today. Indeed, dating back to 1957, the S&P 500 has, on average, returned an impressive 7.96% p.a. outstripping almost all hedge funds.

Monthly Contributions

Historical evidence proves that the S&P 500 is a sound long-term investment, and this is why we are allowing you to take advantage of this growth by investing every month. The “S&P 500 Index Principle Protected Plan” gives you the opportunity to invest in the Index for between 10-20 years, making it perfect for retirement or education fee planning.

Investment Terms and Minimum Contributions

- Investment terms of 10, 15 or 20 years via the Investors Trust S&P 500 Index Saving Plan

- Minimum contributions of US$200 per month or US$2,400 p.a.

Guaranteed Returns

Depending on the length of your investment, Investors Trust offers a guaranteed return of up to 160% of your contributions, giving you that added security.

Charges

- Annual Administration Charge:

- 2% (10 year plan)

- 1.7% (15 year plan)

- 1.1% (20 year plan)

- Policy fee: US$10 monthly

- Structure fee: 0.125% monthly of account balance

Composition of the Fund

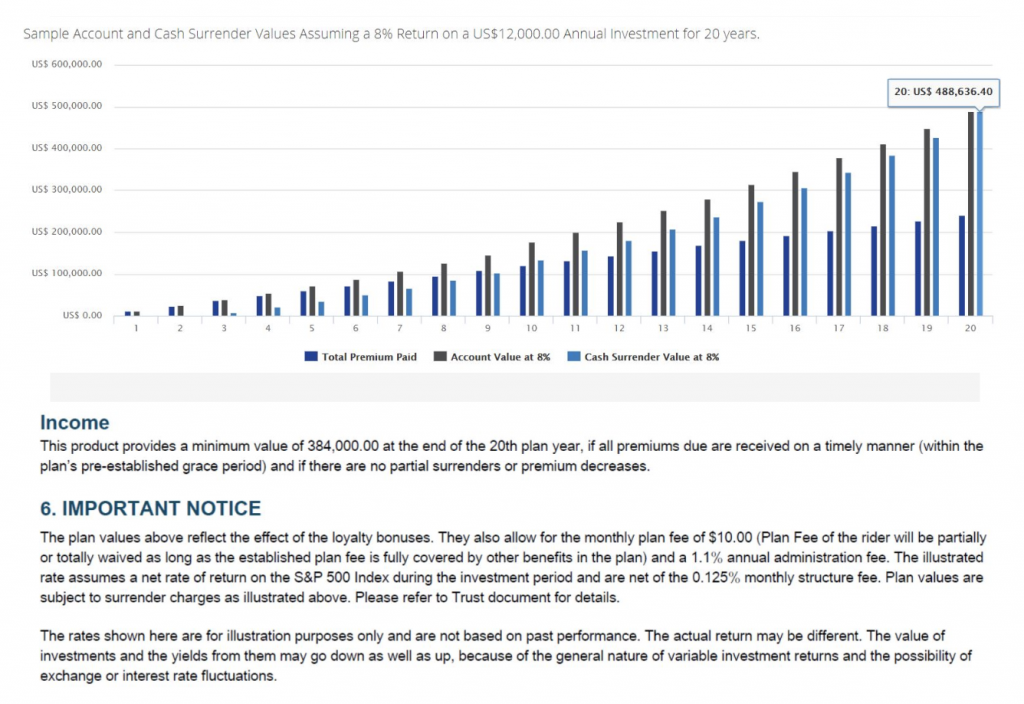

Example – Investing US$1,000 per month for 20 years

In this example we have taken a 45 year old investor, planning to retire at 65.

- The total monthly contributions would be US$240,000 ($1,000 x 240 months)

- The guaranteed minimum return is US$384,000 ($240 x 160%)

- Assumed average 8% growth (in line with the trend from 1957) would give a total return of $488,636

In which jurisdiction will my investment be held?

The Investors Trust is based in the Cayman Islands in the Caribbean. This financial centre is the fifth-largest in the world and is highly respected by some of the world’s leading banks and financial institutions, of which more than 300 have bases there. Approximately 75% of the offshore hedge funds in the world, along with almost half of the industry’s US$1.1 trillion assets under management are in the Cayman Islands.

The Cayman Islands are a UK Crown colony meaning that the existing parliamentary systems and structures, as well as both common law and tax law, are exceptionally well regulated by the highly respected Cayman Islands Monetary Authority.

Life Assurance

Like all of these types of investment, the Investors Trust S&P 500 Index Guarantee includes a guaranteed death benefit, so should you pass away during the investment period, 101% of the policy value would be paid out to your beneficiaries.

The positive with this product

- Historically, the S&P 500 has produced excellent average returns

- It is a straightforward and easy to understand investment strategy

- The strategy is adopted by some of the world’s best-known investors

- There are no limits to the growth that your investment can make

- Guaranteed returns

The negatives with this product

- It is a long-term instrument with the only investment periods available being 10, 15 or 20 years

- The guarantee is only valid if all contributions are made

- Only available in USD

Final points

Investing in the S&P 500 index is one of the least complicated investment strategies and is ideal for retirement planning. At present, there are very few better options available on the market.

Disclaimer

The notes to this publication are intended to be used as a guide and although prepared by financial experts, are written in general terms. In no way should this document be interpreted as financial advice, and the contents should be discussed with your financial advisor or another financial professional. The notes do not cover specific situations, and you should seek professional advice before deciding upon this investment. We do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone relying on the information based in these notes or nay decision based upon it.